HIGH FRAGMENTATION AND UNDER-PENETRATION

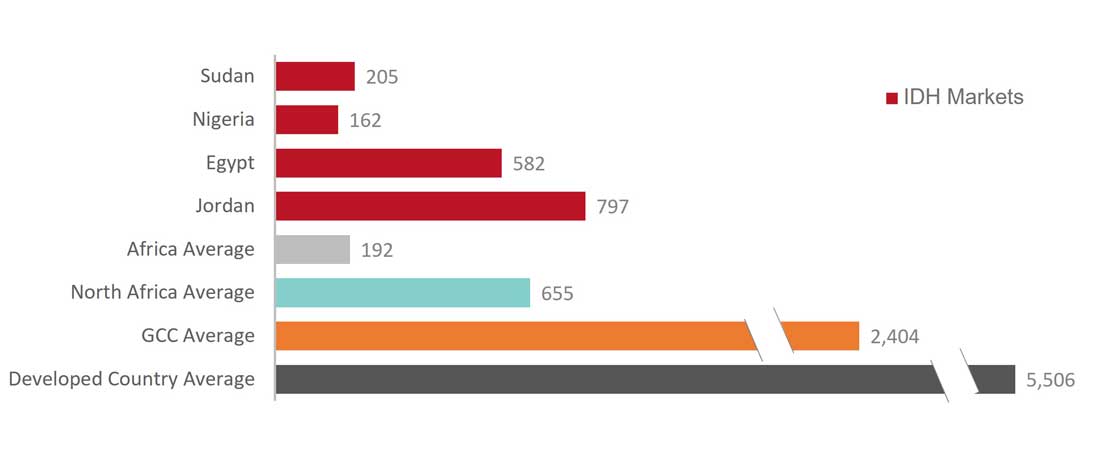

The health expenditures per-capita chart below demonstrates the underpenetrated nature of the regions in which IDH operates. The comparison shows the US and other developed countries outspending Middle Eastern and African countries by a very wide margin on healthcare. IDH’s “Hub, Spoke and Spike” business model enables the Company to expand organically in these highly-fragmented markets characterized by underserved demand for medical diagnostic services.

In Egypt, its largest market, IDH enjoys a 50%+ share of the private chain market segment of the Egyptian Diagnostics Industry as measured by revenues. The Group has a substantially larger footprint than its competitors, which are heavily concentrated in Cairo. Yet there is still substantial room to increase accessibility to lab services by adding branches nationwide for greater coverage of the population. Further, and as a testament to the strength of its brands, the Company is able to sustain higher pricing than its closest competitors.

Total Healthcare Expenditures Per Capita (2019) (2011 PPP* US$)

*PPP: Purchasing power parity is based on the assumption that the exchange rate between two currencies is equal to the ratio of the currencies’ respective purchasing power.

GCC: KSA, Kuwait, UAE, Qatar, Bahrain, Oman

North Africa: Morocco, Tunisia, Algeria

Africa: five most populous countries: Nigeria, Ethiopia, Egypt, DR Congo, Tanzania

Developed countries: USA, Japan, Russia, Italy, Germany, UK, France, Canada

Source: World Bank

Large populations

IDH has an established presence in two of Africa’s three largest countries in terms of population size. Across both Egypt and Nigeria, the population is expected to continue growing in the coming years in turn generating new demand for IDH’s services.

As of December 2024

Source: World Bank

Heightened health consciousness

The underserved and under-resourced healthcare systems in the Middle Eastern and African regions in which IDH operates have reached a critical inflection point. Serious issues include lack of funding, inefficient management, shortage of facilities and lack of qualified medical practitioners.

As the Group’s emerging markets grow, demand for more and better health options will be driven by an emerging middle class. These consumers are increasingly health conscious — they exercise more, chose more nutritious foods and expect access to modern and preventive healthcare.