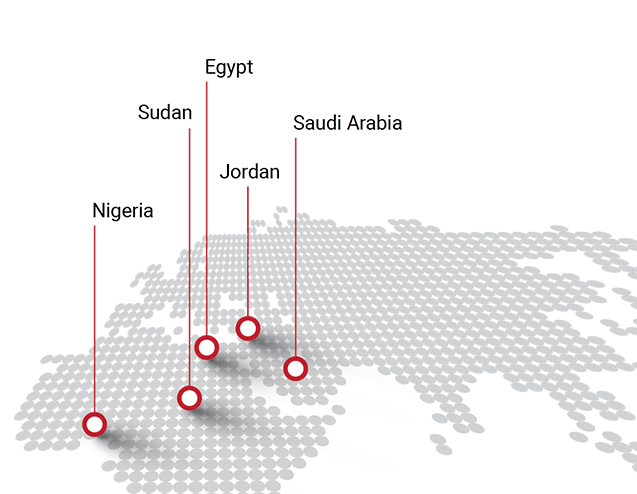

IDH is a leading consumer healthcare company in the Middle East and Africa with operations in Egypt, Jordan, Nigeria, Saudi Arabia, and Sudan.

Egypt is the company’s primary market, contributing 82.5% of total revenues in 2024 followed by Jordan at 15.7%, Nigeria at 1.4%, Saudi Arabia at 0.3%, and Sudan at 0.05%.

Egypt

The Egyptian Diagnostics Industry (EDI) can be broadly divided into public and private sector infrastructure, with the latter including both labs attached to private hospitals and independent standalone labs (chains and single labs). According to the Boston Consulting Group (BCG), IDH is the largest fully-integrated private sector diagnostics service provider, with more than 50% share by revenue of the private chain market in Egypt.

IDH is in a strong competitive position in the EDI, having created formidable barriers to entry with its over 40-year track record and 587 branch network as at year-end 2024. This has been achieved by:

Long-established brands with trusted reputations that have engendered strong patient loyalty.

Strong relationships with key stakeholders including physicians, patients and hospitals

A scalable, asset-light business model that enables expansion in fragmented markets

International accreditations notably the coveted CAP certification of the Mega Lab

Jordan

Jordan has one of the most modern health care infrastructures in the Middle East. Whilst medical services remain highly concentrated in Amman, c. 70% of Jordanians have medical insurance. Notably, medical laboratories must abide by the price list that was issued by the Jordanian Ministry of Health in 2008, which has not since changed. Consequently, Biolab’s strategy is to expand its range of check-up packages offered, thereby increasing the number of tests per patient.

Unlike Al Borg and Al Mokhtabar in Egypt, Biolab does not operate a Hub, Spoke and Spike business model. Whilst Biolab’s 26 central labs perform many of the +1,000 pathology tests offered, four that are considered specialty labs perform particular types of tests including, but not limited to, haematology, endocrinology, immunochemistry, parasitology, oncology, transfusion medicine, molecular genetics and antenatal diagnostics and gene sequencing. Furthermore, Biolab does not share purchasing, supply and logistics, IT, marketing or sales functions with its Egyptian parent company.

Nigeria

The strategic rationale for making Nigeria the fourth country on our regional platform is compelling. Nigeria’s diagnostic services market is very large, highly fragmented and underpenetrated, offering significant opportunities for growth and economies of scale. As importantly, it shares many similarities with Egypt’s market in the 1980s and 1990s in terms of structure, pace of development, and the emerging disease profile of patients. IDH has expanded its geographic platform to four countries with an investment in Nigeria’s promising healthcare industry. The Group closed on a transaction in February 2018 in which it formed a joint venture with Man Capital LLC (“Man Capital”), the London-based investment arm of the Mansour Group, called Dynasty Holding Group (“Dynasty”), which is 51% owned and controlled by IDH. In turn, Dynasty partnered with the International Finance Corporation (“IFC”) to invest in Eagle Eye Echo-Scan Limited (“Echo-Scan”), a leading medical diagnostics business based in Nigeria.

Dynasty and the IFC have committed to invest significant capital in Echo-Scan over the next four years. Dynasty has acquired a majority stake in Echo-Scan and assumed management control of the company, whilst both Dynasty and the IFC will invest US$ 25 million to expand EchoScan’s diagnostics network, service offerings, and quality standards. In building the Echo-Scan brand, Dynasty aims to equate the name with quality and safety, embodying the same core values that have earned the Al Borg and Al Mokhtabar brands strong loyalty in Egypt over the years.

Saudi Arabia

Saudi Arabia marks IDH’s newest geography, with its official inauguration in January 2024. The venture represents a strategic partnership between IDH and its Jordanian Subsidiary, Biolab, with the ultimate aim of creating a full-fledged pathology diagnostic services provider in one of the region’s fastest-growing markets characterized by robust macroeconomic fundamentals and an increasingly health-conscious population. The venture has launched two initial branches in the Kingdom’s capital city, Riyadh, in January 2024 and is gearing up for accelerated growth in the coming period.

Sudan

IDH operates under two brand names in Sudan, Ultralab and Al Mokhtabar Sudan. Al Borg acquired a majority interest in Ultralabs in 2011, whilst Al Mokhtabar Sudan had been established in 2010 prior to the Group’s acquisition of Al Mokhtabar in Egypt. While Al Mokhtabar Sudan operates independently, Ultralab shares purchasing, supply and logistics, and IT functions with the Company’s Egyptian operations. At year end 2024, there were 18 branch labs in Sudan. However, it is important to note that 17 of the Company’s 18 branches in the market have been temporarily shut down due to the ongoing violence in the country. IDH continues to monitor the evolving situation, prioritizing the health and safety of its staff and patients.